Abhishek is an Advocate and a Chartered Accountant practising primarily in the areas of indirect taxes (GST, Customs and pre-GST laws) and Foreign Trade Policy. Abhishek routinely advises clients on diverse issues in relation to these laws.

Abhishek actively represents clients before High Courts, Tribunals, quasi-judicial and departmental authorities across the country. He has represented clients before various forums in several states, namely Maharashtra, Chhattisgarh, Gujarat, Tamil Nadu and Uttar Pradesh. He has also co-briefed some of India’s leading senior advocates.

Abhishek’s articles have been published by reputed news agencies such as Indian Express, Firstpost, Law Street India, Taxsutra and Tax India Online. He has spoken at several forums, including at international conferences in India, USA and Hong Kong.

Abhishek was associated with two of India’s top-ranked firms, namely Khaitan & Co and Vaish Associates, before going independent in 2022.

Comprehensive support from departmental proceedings to Higher Courts, covering strategy, drafting, representation, advance rulings under GST/Customs, and SVB investigations.

Providing legal opinions, conducting health-check exercises, suggesting tax-efficient structures, examining tax implications on proposed transactions, and so forth.

Reviewing agreements, advising on M&A transactions and India entry proposals, conducting due diligence, and so forth.

Submitting representations before and initiating a dialogue with the Central / State governments on behalf of private players / industry associations on various issues.

Abhishek has advised on the following matters, among several others, since establishing his independent practice:

(All intellectual property rights belong to their respective owners)

Advised on export of goods covered under the Special Chemicals, Organisms, Materials, Equipment, and Technologies (SCOMET) list.

Advised on tax implications on alteration of capital structure.

Advised on their joint venture in India with an American subsidiary of a Taiwanese company.

Advised on GST implications on their service agreements.

Represented the Indian subsidiary in Service Tax / GST litigations across Maharashtra, Gujarat and Tamil Nadu.

Represented in Customs litigation in Maharashtra.

Advised on export of goods covered under the Special Chemicals, Organisms, Materials, Equipment, and Technologies (SCOMET) list.

Advised on tax implications on alteration of capital structure.

Represented the Indian subsidiaries in Customs Special Valuation Branch (SVB) investigations.

Represented the Indian subsidiaries in Customs litigations across Maharashtra and Tamil Nadu.

Represented these listed companies in GST litigations across Maharashtra and Uttar Pradesh.

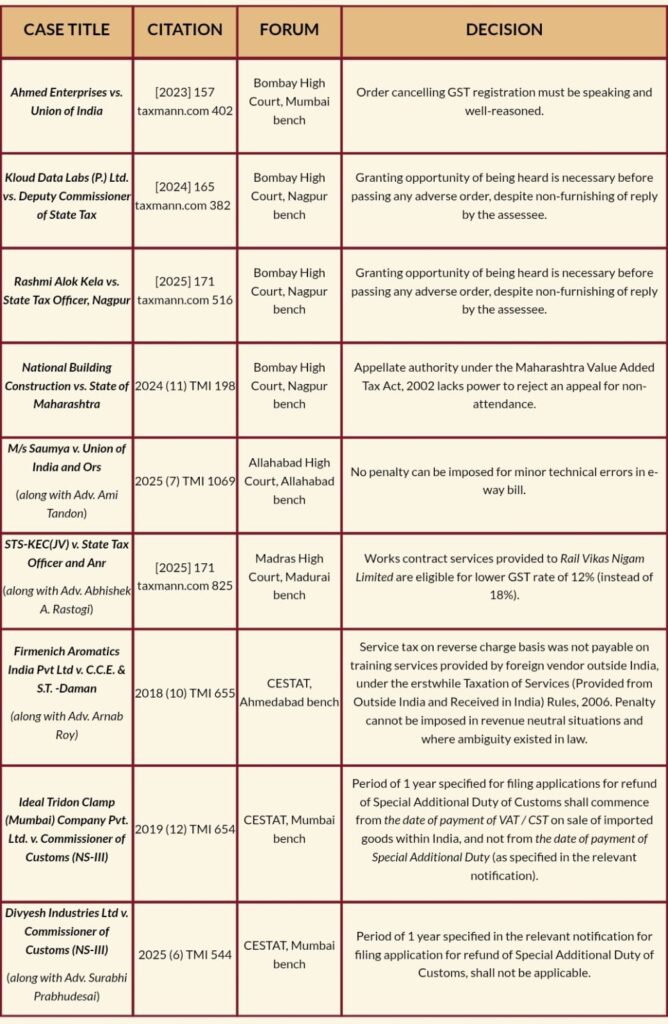

Ahmed Enterprises vs. Union of India

[2023] 157 taxmann.com 402

Bombay High Court, Mumbai bench

Order cancelling GST registration must be speaking and well-reasoned.

Kloud Data Labs (P.) Ltd. vs. Deputy Commissioner of State Tax

[2024] 165 taxmann.com 382

Bombay High Court, Nagpur bench

Granting opportunity of being heard is necessary before passing any adverse order, despite non-furnishing of reply by the assessee.

Rashmi Alok Kela vs. State Tax Officer, Nagpur

[2025] 171 taxmann.com 516

Bombay High Court, Nagpur bench

Granting opportunity of being heard is necessary before passing any adverse order, despite non-furnishing of reply by the assessee.

National Building Construction vs. State of Maharashtra

2024 (11) TMI 198

Bombay High Court, Nagpur bench

Appellate authority under the Maharashtra Value Added Tax Act, 2002 lacks power to reject an appeal for non-attendance.

Parshv Industries LLP vs. Assistant commissioner, CGST , Nagpur – II

Writ Petition No 2287 of 2025

Bombay High Court

Incase where input tax credit has been alleged to be availed on purchases made from ” non – existent” entities, documentary evidence must be relied upon

M/s Saumya v. Union of India and Ors

(along with Adv. Ami Tandon)

2025 (7) TMI 1069

Allahabad High Court, Allahabad bench

No penalty can be imposed for minor technical errors in e-way bill.

STS-KEC(JV) v. State Tax Officer and Anr

(along with Adv. Abhishek A. Rastogi)

[2025] 171 taxmann.com 825

Madras High Court, Madurai bench

Works contract services provided to Rail Vikas Nigam Limited are eligible for lower GST rate of 12% (instead of 18%).

Firmenich Aromatics India Pvt Ltd v. C.C.E. & S.T. -Daman

(along with Adv. Arnab Roy)

2018 (10) TMI 655

CESTAT, Ahmedabad bench

Service tax on reverse charge basis was not payable on training services provided by foreign vendor outside India, under the erstwhile Taxation of Services (Provided from Outside India and Received in India) Rules, 2006. Penalty cannot be imposed in revenue neutral situations and where ambiguity existed in law.

Ideal Tridon Clamp (Mumbai) Company Pvt. Ltd. v. Commissioner of Customs (NS-III)

2019 (12) TMI 654

CESTAT, Mumbai bench

Period of 1 year specified for filing applications for refund of Special Additional Duty of Customs shall commence from the date of payment of VAT / CST on sale of imported goods within India, and not from the date of payment of Special Additional Duty (as specified in the relevant notification).

Divyesh Industries Ltd v. Commissioner of Customs (NS-III)

(along with Adv. Surabhi Prabhudesai)

2025 (6) TMI 544

CESTAT, Mumbai bench

Period of 1 year specified in the relevant notification for filing application for refund of Special Additional Duty of Customs, shall not be applicable.

(All intellectual property rights belong to their respective owners)

Budget 2023: Narendra Modi government’s first Budget in Amrit Kaal; scales newer heights

(co-authored with Adv. Abhishek A. Rastogi)

Virtual Currencies: Let Market Forces Determine the Future

(co-authored with Adv. Rashmi Deshpande)

All Hands on Deck – What Taxman Should do to Ease COVID-19 Distress

(co-authored with Adv. Rashmi Deshpande)

Madras High Court decision on transition of cesses: A case of too little, too late

(co-authored with Adv. Rashmi Deshpande)

Real Estate Sector – A dissection of the recent GST changes

(co-authored with Adv. Surabhi Prabhudesai)

Inclusion of post import marketing expenses in assessable value

(co-authored with Adv. Arnab Roy)

(All intellectual property rights belong to their respective owners)

Conducted a seminar on the topic “GST on Real Estate Transactions: Impact, Challenges and Solutions”.

Invited to judge two rounds of the 1st MNLU, Nagpur National Moot Court Competition, 2022, carrying the theme “Intersection between Constitutional Law and Technology Law”.

Invited as a panellist for discussion on the topic “Navigating the Crypto Ecosystem in 2022”.

Interviewed about growing up in Nagpur, qualifying as a Chartered Accountant, the decision to pursue LLB thereafter, and life at a top-ranked law firm

Delivered a lecture titled “GST Talk”.

Selected as one of the 300 candidates to attend the Harvard Project for Asian and International Relations conference in USA. Delivered a presentation on the topic “Reshaping the traditional taxi industry”.

Selected as one of the 500 candidates to attend the Harvard Project for Asian and International Relations conference in Hong Kong. Delivered a presentation on the topic “Maximising Social Impact through Strategic Portfolio Investments”, which won the third prize in the case study competition hosted by Deloitte Consulting LLP.

Participated in the Harvard US-India Initiative conferences held in Delhi and Mumbai. Delivered a presentation on the topic “Analysis of the Right of Children to Free and Compulsory Education Act, 2009”, which was selected for the final rounds of the Policy Proposal Competition hosted by Vidhi Centre for Legal Policy.

Nagpur

201, Dream Aura, Plot No 185/1, Gandhi Nagar, Nagpur, Maharashtra – 440 010

Mumbai

32-B/4, Takshila, Mahakali Caves Road, Andheri (East), Mumbai, Maharashtra – 400 093

Email abhishek@anchambers.in

Internships – Please send your CV with a one-page writing sample (on any legal issue) at internships@anchambers.in

This website is for informational purposes only. The Bar Council of India does not permit advertisement or solicitation of work. By accessing this website, you acknowledge that you are seeking information about the Chambers of Abhishek Naik of your own accord and there has been no attempt to advertise or solicit work.The information contained in this website does not constitute legal opinion or advice. The information obtained or downloaded from this website does not lead to creation of a lawyer-client relationship